Web3 Gaming Taxes Are No Longer Avoidable

Yes, web3 gaming taxes will apply to token rewards, NFT trades, and in-game transactions. Jurisdictions like the UAE are already adopting global reporting rules, and other countries will follow. The era of sidestepping taxes through jurisdictional loopholes is coming to an end.

Key Takeaways

- Web3 gaming taxes are now unavoidable, applying to token rewards, NFT trades, and in-game transactions.

- The UAE’s adoption of CARF signals a global shift towards transparent crypto tax reporting.

- Micro-transactions in games lead to a high volume of taxable events, complicating compliance for players.

- To succeed, Web3 gaming platforms must prioritize ‘compliance by design,’ integrating tax reporting from the start.

- Embracing compliance can build trust and become a competitive advantage in the evolving Web3 gaming landscape.

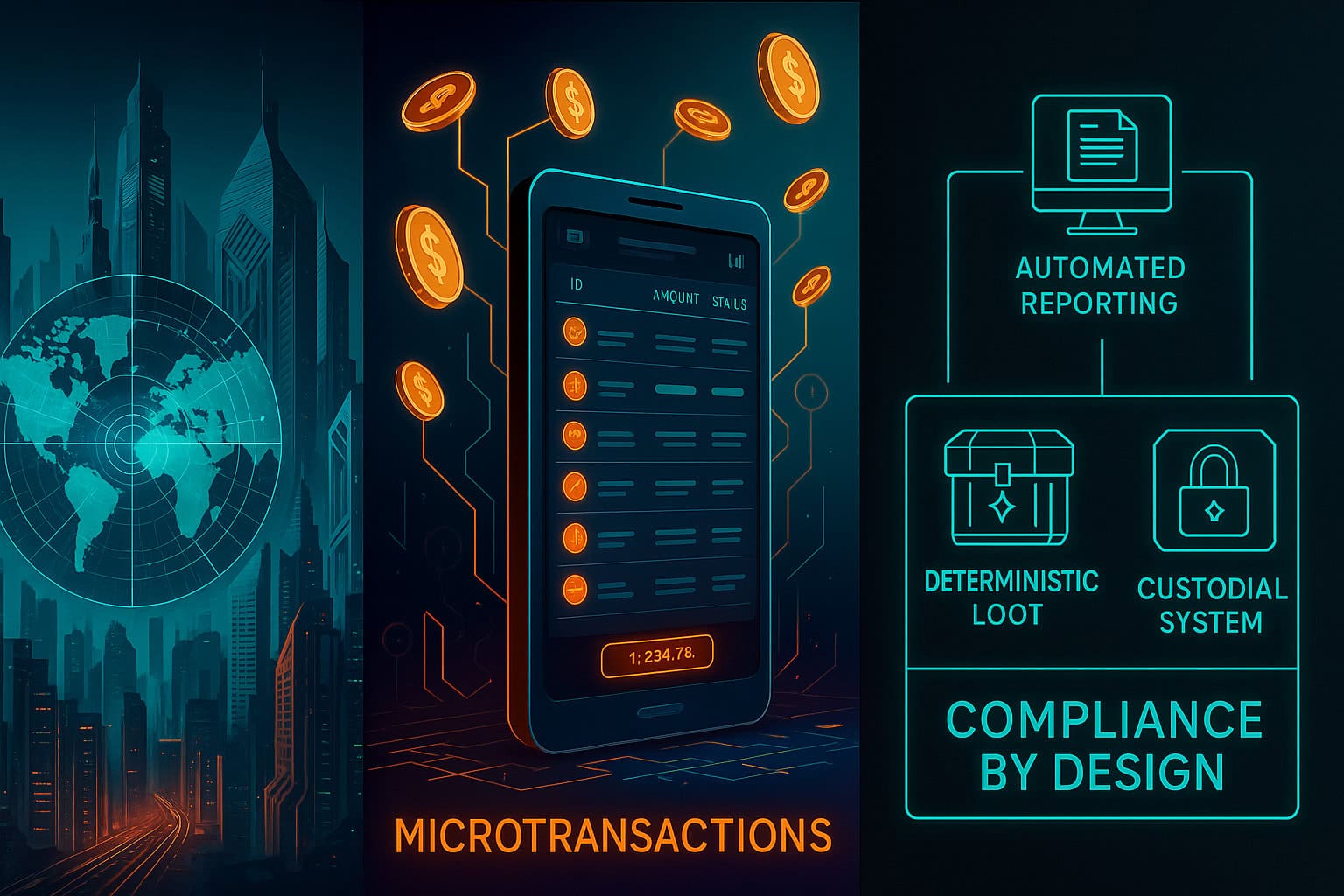

The Micro-Transaction Problem

Gaming brings a unique challenge to taxation. A typical crypto investor might make dozens of trades in a year. A dedicated Web3 gamer, on the other hand, can generate thousands of taxable events each month. Every loot drop tied to a token, every NFT sale, every in-game currency conversion could count as a separate taxable transaction.

One example makes this scale clear. A gamer who owned land inside a blockchain-based world reported more than 1.5 million individual transactions in a single year, simply from collecting small taxes each time other players used their land. Under today’s rules, every one of those could be treated as a taxable event.

This creates a mismatch between player activity and the tools currently available. Popular tax services like Koinly or Divly charge per transaction, often at rates higher than the taxable gain itself. For a gamer earning fractions of a dollar through in-game actions, the compliance cost could easily exceed their actual income.

The result? A looming tax nightmare unless the industry adapts.

Compliance by Design, Not Afterthought

For Web3 gaming to scale, compliance must move from being a user’s responsibility to being part of the infrastructure. That means platforms and developers need to design with tax transparency in mind from day one.

In practice, this could mean:

- Automatic aggregation: Platforms batch thousands of micro-transactions into player-friendly statements.

- Deterministic loot mechanics: Loot tied to skill or milestones, not chance, keeping games outside gambling classifications.

- Custodial reporting: Platforms handle reporting obligations, sparing players the nightmare of manual reconciliation.

Studios that ignore this will expose both themselves and their players to regulatory risk. Those that succeed will turn compliance into a competitive edge.

A Global Trend That Won’t Stop

The UAE’s commitment to the OECD’s Crypto-Asset Reporting Framework (CARF) is part of a bigger global shift. Europe’s MiCA framework, IRS enforcement in the United States, and rising pressure in Asia all point in the same direction. Governments see billions in untaxed crypto activity, and Web3 games — with their vibrant player economies — are a natural target.

This creates risk, but also opportunity. Studios that embrace compliance can build trust with investors, publishers, and regulators. Players, too, will benefit from transparent systems that eliminate the stress of managing taxes on their own.

As CARF-style reporting spreads beyond the UAE, web3 gaming taxes will become a routine part of running any on-chain game economy.

Turning a Pain Point Into an Advantage

Web3 gaming has long been criticized for focusing on tokens first and games second. Now, the industry faces another reality check: compliance is not optional. The challenge is to turn this into a strength.

By embedding automated reporting, designing sustainable token economies, and offering player protections like insurance funds, platforms can make compliance invisible. Done right, taxes won’t be a barrier to adoption — they’ll be a sign that Web3 gaming is ready for the mainstream.

Conclusion

The lesson from the UAE is simple: tax transparency is coming for everyone. Web3 gaming companies that prepare today — by building compliance into their infrastructure — will not only avoid headaches tomorrow but also set themselves apart as leaders in a maturing industry.

The winners of this next chapter won’t just build fun games. They’ll build trust.

OECD CARF explainer (Step-by-step guide PDF):

Blockworks — “UAE to adopt global crypto tax reporting framework”:

Arabian Business — “UAE announces new tax reporting rules for crypto assets”:

Yes. Token rewards, NFT sales, and even in-game currency exchanges can all create taxable events.

Because gamers can generate thousands — or even millions — of tiny transactions, making compliance far more complex and costly.

Not for long. With global tax reporting frameworks like CARF, jurisdictions will share data across borders.

Adopt compliance-by-design infrastructure: automated reporting, deterministic loot, and custodial systems that ease the burden on players.